BTC Price Prediction: Can Bitcoin Defy Profit-Taking to Reach $200,000?

#BTC

- Technical Strength: Price above key moving averages with Bollinger Band expansion signaling volatility uptick

- Institutional Catalysts: Corporate treasury movements and payment integrations building fundamental support

- Sentiment Divergence: Retail profit-taking countered by whale accumulation patterns

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

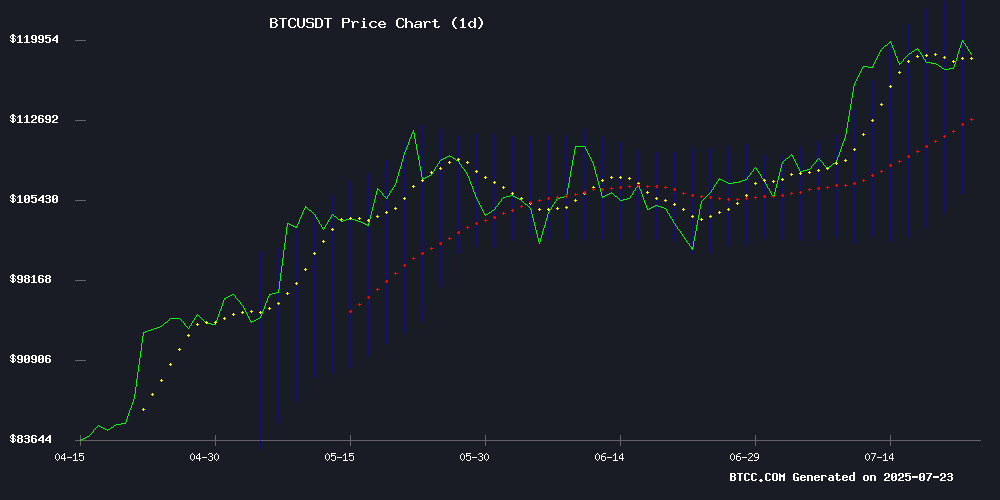

BTC is currently trading at, comfortably above its 20-day moving average (115,418.12), indicating a bullish near-term trend. The MACD histogram shows a slight bearish crossover (-629.98), but the narrowing gap between the signal and MACD lines suggests weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band (124,132.24), signaling potential overbought conditions, though the middle band (115,418.12) acts as strong support.

According to BTCC analyst Michael,

Market Sentiment: Altcoin Rotation Sparks Short-Term Caution, But Institutional Demand Fuels BTC Optimism

News headlines reflect a bifurcated sentiment: while some capital rotates to altcoins, institutional interest remains robust with SpaceX's 1,300 BTC MOVE and Square's merchant onboarding. Michael notes,Futures markets show hesitation at central pivots, but spot volumes suggest underlying strength.

Key bullish catalysts include:

- Wall Street's growing BTC treasury adoption outperforming ETFs

- Sustained trading volume above $120K

- Analyst consensus for $180K year-end targets

Factors Influencing BTC's Price

Bitcoin Faces Near-term Fragility as Capital Rotates to Altcoins

Bitcoin's bull market is entering a delicate phase as long-term holders begin taking profits, according to Bitfinex analysts. The cryptocurrency has consolidated since hitting its all-time high last week, with structural strength intact but near-term vulnerability emerging.

On-chain data reveals a significant shift in ownership dynamics. Long-term investors are distributing holdings to exchanges, while new buyers—including ETF participants and institutional players—absorb the supply. This rotation mirrors typical bull market behavior but introduces fragility if spot demand weakens.

Nearly all circulating BTC now sits in profitable positions, with prices hovering above the 95th percentile historically. The market's next MOVE hinges on whether fresh capital can sustain momentum or if consolidation will deepen.

Bitcoin Price Sets Up for Another Move—Can the Bulls Seal the Deal?

Bitcoin's price action suggests another upward push as it eyes a breakthrough above the $120,000 resistance level. The cryptocurrency has already cleared the $118,000 barrier, trading firmly above $118,500 and the 100-hour Simple Moving Average.

A bullish trend reversal was confirmed with a break above the $118,000 resistance line on the BTC/USD hourly chart, sourced from Kraken. The next critical hurdle lies at $120,000—a decisive close above this level could ignite further gains.

After a brief dip to $116,260, Bitcoin regained momentum, testing $120,237 before consolidating near the 23.6% Fibonacci retracement level. Market participants now watch for a sustained move toward $121,000, which would signal renewed bullish conviction.

Bitcoin Treasury Firms Outperform ETFs as $120,000 Milestone Drives Wall Street Interest

Bitcoin treasury companies are gaining traction as an alternative to ETFs, focusing on direct accumulation of cryptocurrency assets rather than market tracking. Twenty-One Capital, backed by Tether and SoftBank, is set to go public via a merger with Cantor Equity Partners, signaling growing institutional interest.

The treasury strategy, pioneered by MicroStrategy's Michael Saylor, offers distinct advantages for mainstream investors. "We're founded as a bitcoin business with a core goal of increasing Bitcoin per share," said Mallers of Twenty-One Capital. This approach simplifies cryptocurrency exposure for traditional investors who lack access to crypto exchanges or technical expertise for self-custody.

The model addresses practical barriers in public markets, positioning Bitcoin as a more accessible asset class. With Bitcoin's price target of $120,000 fueling Wall Street's appetite, treasury firms are emerging as a compelling vehicle for institutional adoption.

Bitcoin July Futures Stalemate at Central Pivot as Bulls Eye Breakout

Bitcoin's July futures contract remains trapped in a tight range, with the BTCN2025 oscillating between key pivots at 123,875 and 115,340. The central rejection at 120,615 highlights market indecision, leaving traders awaiting a decisive move.

Three critical levels now dictate the next phase: A bullish breakout above 126,015 could propel a retest of 123,875 and open the path toward 129,000–132,000. Conversely, failure to hold 120,615 risks a slide to 115,340, with 112,000 as the next support. Prolonged congestion NEAR 120,000–121,000 may signal diminishing volatility into month-end.

The ascending channel since early May remains intact, reinforcing the bullish structure. Volume profiles confirm concentrated activity between the pivots, underscoring their technical significance.

Bitcoin Surges Past $120K as Exchange Volumes Signal Bullish Momentum

Bitcoin breached the $120,000 threshold on Tuesday, fueled by a resurgence in spot trading activity across major exchanges. The rally comes as BTC approaches its all-time high, with Binance leading volume growth at $8.8 billion - a 184% increase from pre-rally levels.

Market participation broadened as open interest jumped 7.3% to $45.4 billion, breaking through previous resistance levels. "Binance's sustained volume dominance post-ATH suggests retail traders are driving this leg of the rally," noted Julio Moreno of CryptoQuant.

While Coinbase, OKX and Bybit collectively saw volumes spike to $12.7 billion, activity contracted elsewhere after BTC tested $123,000. The divergence highlights Binance's outsized role in price discovery during parabolic moves.

Bitcoin Must Defend Key Support to Reach $180,000 Year-End Target, Analyst Says

Bitcoin hovers near $119,000 after setting a new all-time high above $123,000 last week. On-chain metrics paint a mixed picture for the cryptocurrency's trajectory. Exchange reserves have climbed since late June, signaling heightened profit-taking that could pressure prices short-term.

Large holders and miners accelerated deposits starting July 18, though overall exchange inflows remain subdued compared to previous market tops. The declining UTXO count suggests long-term accumulation, with investors consolidating holdings into fewer wallets—a typically bullish indicator.

Institutional demand appears robust, with nearly $50 billion flowing into Bitcoin products year-to-date. The market now watches whether BTC can maintain critical support levels to validate ambitious year-end price projections.

SpaceX Moves Bitcoin For First Time In 3 Years: $153M In Play

Bitcoin has surged more than 20% since late June, reaching a new all-time high of $123,000 before entering a consolidation phase. The cryptocurrency is now trading in a tight range, with bullish support holding firm above $117,000 as the market absorbs recent gains. While momentum has slowed, institutional interest continues to grow, and key on-chain metrics suggest further upside potential in the coming months.

Blockchain analytics platform Arkham reported that SpaceX moved 1,300 BTC—worth approximately $153 million—to a new address, marking the company's first Bitcoin transaction in three years. The motive behind the transfer remains unclear, sparking speculation about potential custody changes or broader institutional activity.

Technical strength, increasing corporate engagement, and mainstream adoption are painting a bullish midterm outlook for Bitcoin. Traders and analysts are closely monitoring the market for a decisive breakout or breakdown to confirm the next trend phase.

SpaceX Moves 1,300 BTC After Three-Year Dormancy, Sparking Market Speculation

SpaceX, the aerospace manufacturer founded by Elon Musk, has transferred 1,300 BTC ($153 million) to a new address after three years of inactivity. The move, flagged by Arkham Intelligence, has ignited debate over whether the company is rotating custody wallets or preparing to liquidate holdings.

The transaction marks SpaceX's first major Bitcoin movement since 2022. Market observers are divided—some view this as routine security protocol, while others speculate about strategic portfolio rebalancing. The dormant holdings' sudden activation carries symbolic weight for institutional crypto adoption.

Jack Dorsey’s Square Begins Onboarding Merchants for Bitcoin Payments

Square, a business unit of Block, is rolling out Bitcoin payment capabilities for its 4 million merchants, leveraging existing point-of-sale terminals and the Lightning Network. The integration eliminates traditional hurdles like high fees and slow confirmations, offering near-instant settlements with optional dollar conversion.

The move coincides with Bitcoin's bullish momentum, trading above $118,000 amid institutional demand. Square's scale could accelerate mainstream retail adoption in the U.S., where business-level crypto acceptance has lagged despite growing institutional interest.

Owen Jennings, a Square executive, confirmed the first merchant onboarding via Twitter: "boom.today we're onboarding our first few @Square sellers for the new native bitcoin acceptance experience—this is the way!" The development follows months of internal testing and requires no additional hardware.

Bitcoin Faces Profit-Taking but Bullish Signals Suggest Rally Isn't Over

Bitcoin's recent dip, driven by institutional profit-taking, hasn't erased bullish momentum. Whale and miner activity remains strong, fueling expectations of another leg up. The cryptocurrency is consolidating near its all-time high of $123,000—a typical accumulation zone before breakout.

Long-term holders are cashing out at the highest rate this year, with the Spent Output Profit Ratio hitting 2.5. Yet it remains below the 4.0 threshold that historically marks market tops. This suggests room for further gains despite current selling pressure.

The Binary Coin Days Destroyed indicator flashes warning signs at a reading of 1, signaling sustained LTH selling. Should this continue, Bitcoin may face downward pressure. But for now, the market structure points to unfinished business on the upside.

Bitcoin's Promise and Peril Amid Dollar Distrust

Prominent investors like Tim Draper are positioning Bitcoin as the inevitable successor to fiat currencies, arguing that systemic distrust in traditional banking will drive mass adoption. The cryptocurrency's hard-capped supply of 21 million coins presents a compelling hedge against inflationary monetary policies eroding the dollar's value.

Decentralization remains Bitcoin's core selling point—transactions Immutable on the blockchain, beyond the reach of bank freezes or government intervention. This narrative gains traction as retail investors seek alternatives after witnessing preferential treatment of institutions during financial crises.

Yet beneath the libertarian ideal lies volatility rarely acknowledged by crypto evangelists. The very features that make Bitcoin resistant to centralized control also expose holders to wild price swings and irreversible transaction errors—risks magnified for small investors allocating life savings.

Will BTC Price Hit 200000?

While $200,000 represents a 68% upside from current levels, technicals and fundamentals suggest a plausible path:

| Factor | Bull Case | Bear Case |

|---|---|---|

| Technical | Break above upper Bollinger (124K) opens path to 161.8% Fib extension at 198K | MACD crossover failure may trigger pullback to 100K |

| Fundamental | Institutional inflows (SpaceX, Square) could accelerate | Altseason capital rotation persists |

| Timeframe | Q4 2025 most likely if ETF inflows resume | |

Michael concludes: "The $180K year-end target appears achievable first, with $200K possible if SpaceX-style corporate adoption becomes a trend rather than an outlier."